Chapter 6 Risk Aversion And Capital Allocation To Risky Assets

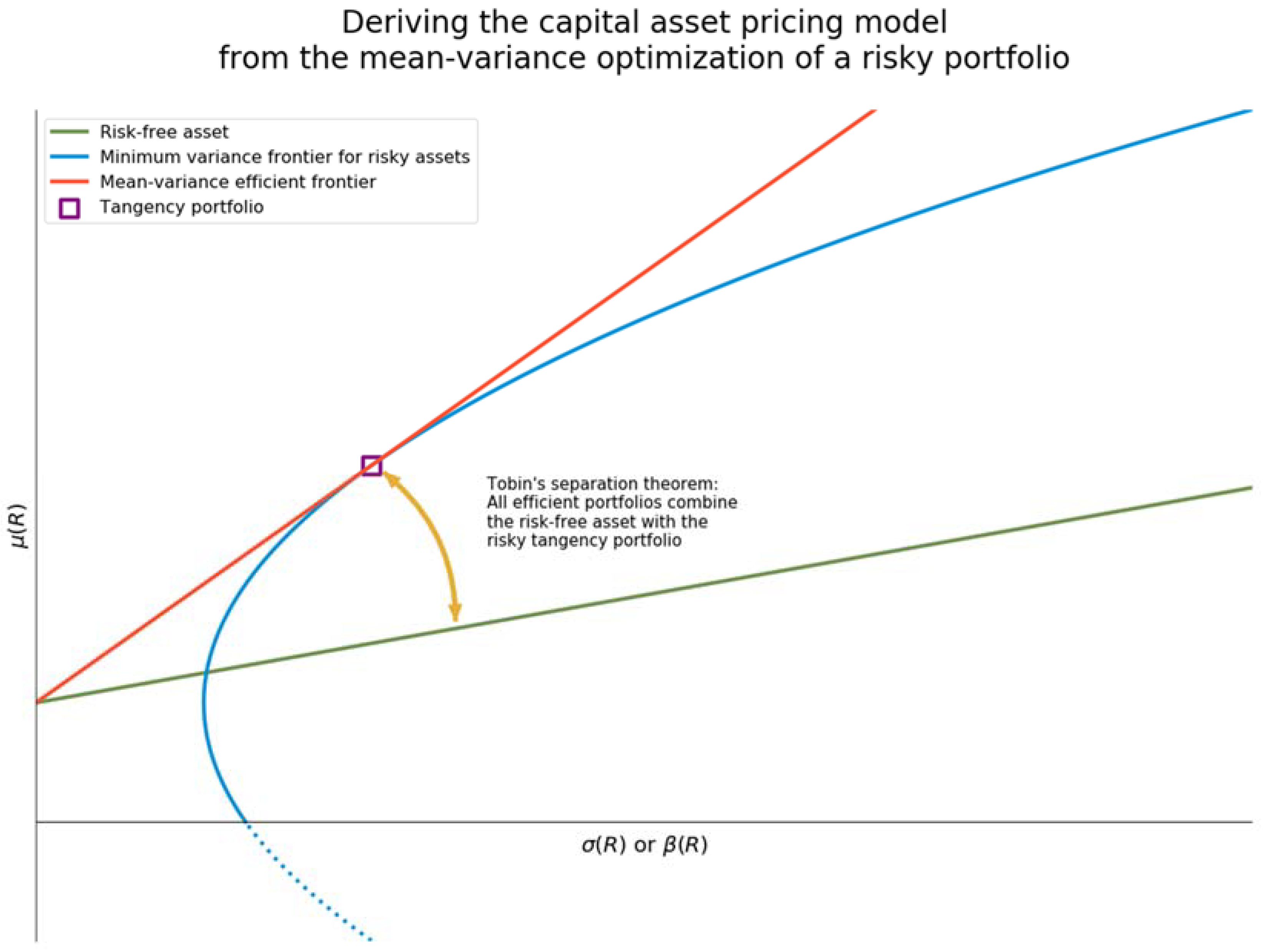

Up to 3 cash back a risky and risk-free asset is the capital allocation line CAL Reward-to-volatility ratio aka Sharpe ratio Ratio of excess return to portfolio standard deviation. CHAPTER 6 RISK AVERSION AND CAPITAL ALLOCATION TO.

Doc Bkm Ch 06 Answers W Cfa Mark Jubber Academia Edu

When we specify utility by U Er 05Aσ 2 the utility level for T-bills is.

. CHAPTER 6 RISK AVERSION AND CAPITAL ALLOCATION TO RISKY ASSETS 6 -1 Outline of the Chapter Risk Difference. No reproduction or distribution without the. For a given expected cash flow portfolios that command greater risk premia must sell at lower prices.

A portfolio that pays 12 percent with 20 percent probability or 2 percent with 80 percent probability. 05 200000 135000 With a risk premium of 8 over the risk. RISK AVERSION AND CAPITAL ALLOCATION TO RISKY ASSETS PROBLEM SETS 1.

View Notes - chapter 6 from FEAS 31101 at Boğaziçi University. Chapter 06 - Risk Aversion and Capital Allocation to Risky Assets 6-2 d. RISK AVERSION AND CAPITAL ALLOCATION TO RISKY ASSETS 6-6 Copyright 2021 McGraw-Hill Education.

For a given expected cash flow portfolios that command greater risk premia must sell at lower prices. Capital Allocation To Risky Assets PDF Risk Aversion. Consider the following information about a risky portfolio that you manage and a risk-free asset.

Hence risk aversion and specula琀. Your client wants to invest a proportion of her total. CAPITAL ALLOCATION TO RISKY ASSETS.

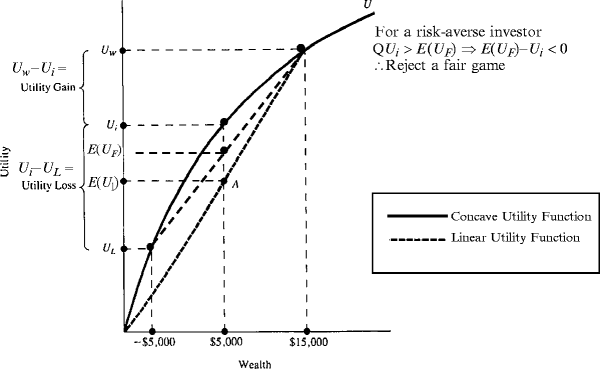

The expected cash flow is. E The first two answer choices are incorrect because a highly risk averse investor would avoid portfolios with. A fair game is a risky prospect that.

RISK AVERSION AND CAPITAL ALLOCATION TO RISKY ASSETS 1. RISK AVERSION AND CAPITAL ALLOCATION TO RISKY ASSETS 1. 05 70000 05 200000 135000 With a.

Up to 3 cash back Chapter Six. To turn a gamble into a specula琀椀ve prospect requires an adequate risk premium to compensate risk-averse investors for the risk they bear. Investors will avoid risk unless there is a reward.

007 The utility level for the. View Test Prep - RISK AVERSION AND CAPITAL ALLOCATION TO RISKY ASSETS from FIN 6537 at Florida Atlantic University. Chapter 06 - Risk Aversion and Capital Allocation to Risky Assets 6-1 CHAPTER 6.

A portfolio has an expected rate of return of 015 and a standard deviation of. ErP 11 σP 15 rf 5. Chapter 06 - Risk Aversion and Capital Allocation to Risky Assets 6-2 d.

The expected cash flow is. RISK AVERSION AND CAPITAL ALLOCATION TO RISKY ASSETS 6-2 5. 6-2 Allocation to Risky Assets Speculation is the undertaking of a risky investment for its risk premium.

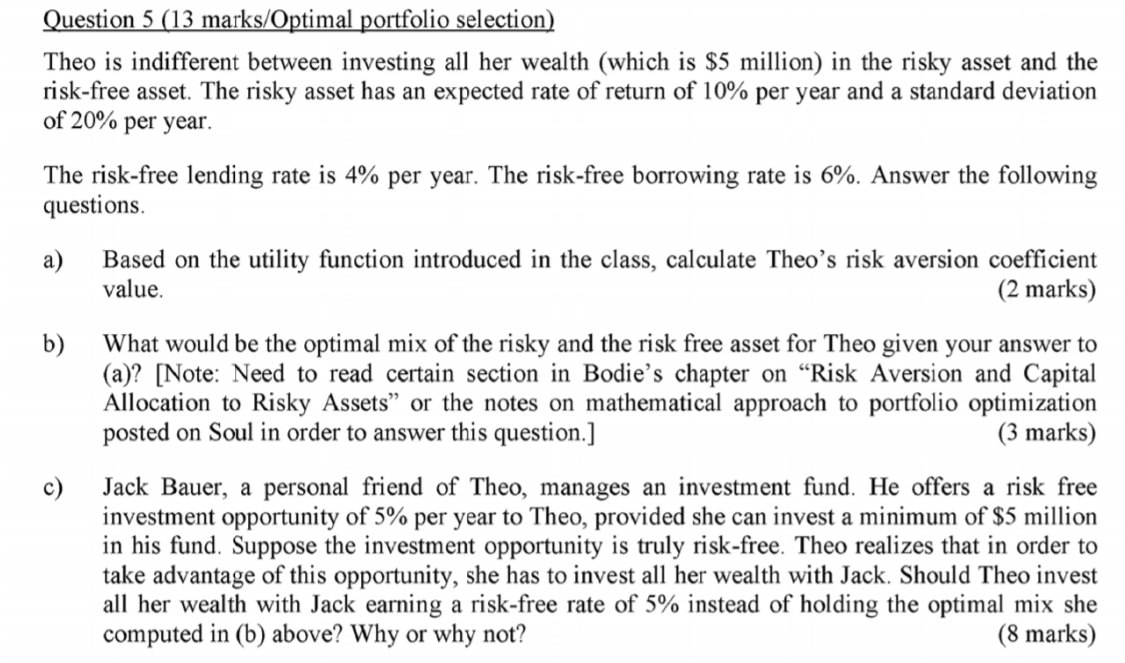

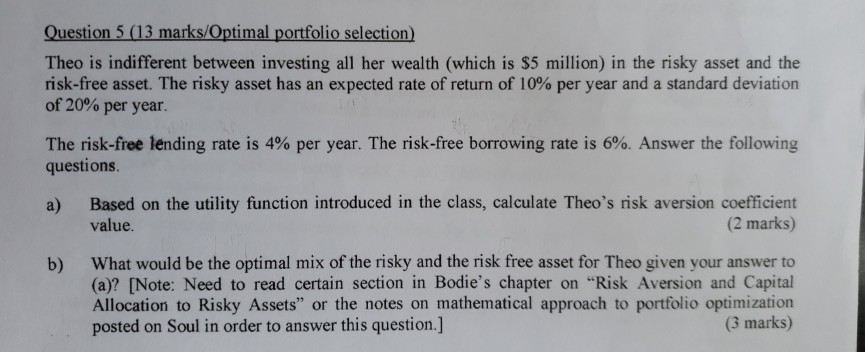

Question 5 13 Marks Optimal Portfolio Selection Chegg Com

Capital Allocation To Risky Assets Ppt Download

Encyclopedia Free Full Text The Capital Asset Pricing Model Html

Ppt Chapter 6 Powerpoint Presentation Free Download Id 1389801

Risky Asset An Overview Sciencedirect Topics

Question 5 13 Marks Optimal Portfolio Selection Chegg Com

Chapter Six Capital Allocation To Risky Assets Pdf Risk Aversion Modern Portfolio Theory

Lecture 5 Chapters 6 7 Optimal Capital Allocation To Risky And Risk Free Assets Flashcards Quizlet

Chapter 6 Risks Multiple Choice Questions Which Of The Following Statements Regarding Studocu

Quiz 5 Chapter 6 Question 1 Correct Mark 1 Out Of 1 Question 2 Correct Mark 1 Out Of 1 Studocu

Chapter 6 Capital Allocation To Risky Assets Capital Alloca琀椀on To Risky Assets Por琀昀olio Studeersnel

Solutions Exercises Ch6 Bkm 12th Capital Allocation To Risky Assets Chapter 6 Risk Aversion And Studeersnel

Ppt Risk Aversion And Capital Allocation To Risky Asset Powerpoint Presentation Id 1469260

Pdf Chapter 6 Risk Aversion And Capital Allocation To Risky Assets Up Start Academia Edu

Actsc371 Lecture Notes Fall 2016 Lecture 1 Utility Expected Return Capital Market

Risk Aversion Capital Asset Allocation And Markowitz Portfolio Selection Model Springerlink

Lecture 5 Chapters 6 7 Optimal Capital Allocation To Risky And Risk Free Assets Flashcards Quizlet